CTS Insurance Comparison Service

Connect, Compare, Choose

Helping you connect with the top UK insurance providers to potentially save time and money

Connect and Compare 120+ providers

You could save up to £523 on car insurance*

Get personalised quotes in minutes

At CTS we are committed to helping you find the right insurance at the right price, by offering access to comparison tools, to help you save time and money.

CTS is here to help our members and friends whether you want to insure your car, van, home or family pet.

You can complete an online quote and buy your policy – keep it simple.

To compare car insurance, home insurance or van insurance just complete the online quotation questions. The quote tool will then search a panel of insurers to find a quote that will meet your requirements.

We're thrilled to announce a perk for our valued CTS members. Now, when you purchase your insurance through the insurance comparison site on our website, you get exclusive rewards!

🚗 Car Insurance - £10 Amazon Voucher 🚐 Van Insurance - £10 Amazon Voucher 🏍️ Bike Insurance - £10 Amazon Voucher 🏠 Home Insurance - £10 Amazon Voucher 🐾 Pet Insurance - £5 Amazon Voucher 🚲 Bicycle Insurance - £5 Amazon Voucher

When you purchase your insurance through this site, you can claim your voucher by contacting our team to verify your purchase. Terms and conditions apply.

You must be a member to get these rewards. Head over to

our website now to take advantage of this incredible benefit and start earning rewards today!

Helping you connect with the top UK insurance providers to potentially save time and money

The right car insurance quote is only a few clicks away...

“Whether your current policy is approaching its renewal date, or you’ve just bought a new car and need cover so you can drive it, you could save yourself up to £523* by comparing car insurance policies with Quotezone.”.

Provide details about you and your car

The quote tool will show you a bespoke list of policies, generated based on your requirements. All you need to do is pick the one that’s right for you.

Find the cover you need

Confirming how you use your car will help the quote tool find the right type of policy for you.

Choose the right policy for your needs

The quote tool will show you a bespoke list of policies, generated based on your requirements. All you need to do is pick the one that’s right for you.

What are the different types of car insurance?

Different types of car insurance provide different levels of coverage, and the premiums for each will vary depending on the additional coverage they offer. It is essential to consider your cover needs when selecting a type of car insurance.

Third-Party Car Insurance Comparison

Third-party insurance is the lowest level of coverage a driver in the UK can have, but not necessarily in terms of cost. It only covers damage incurred to other drivers and their cars in the event of an accident. Also, third-party insurance coverage will not cover repairing or replacing your vehicle.

Third-Party, Fire and Theft Car Insurance Comparison

Third-party, fire and theft insurance includes all third-party insurance and cars stolen or damaged by fire. Importantly, this level of insurance does not cover the costs of damage to your vehicle in an accident.

Fully Comprehensive Car Insurance Comparison

Fully comprehensive car insurance provides the highest overall level of coverage. Also, it is fully comprehensive, includes coverage from all other policy types and physically protects the driver. For example, fully comprehensive car insurance coverage could cover medical treatment and legal costs. Despite offering the highest level of coverage, this type of insurance can often be very affordable. Compare fully comprehensive insurance with CTS to see how much you can save.

Does anything affect the cost of car insurance?

There are a number of factors which affect the cost of car insurance premiums. It is essential to consider these factors before buying a vehicle. Ensure that your car is affordable at this time and that you can cover the insurance cost.

Making a Claim

Once you have claimed your car insurance, your premium will increase. This is because you are now deemed a greater risk, and history has shown you are likelier to make a claim. On the other hand, not making claims and maintaining a no-claims discount will bring your annual premium down.

Age

A driver’s age plays a massive part in how expensive their car insurance will be. Older drivers tend to pay far less than younger and new drivers. This is because they are considered more experienced and less likely to take risks on the road. Therefore, they are less of a liability. For brand-new drivers, your premium is expected to be exceedingly high. This will decrease the older you get and the fewer claims you make.

Profession

The profession of a driver is also considered when assessing an insurance policy. Some jobs are considered riskier than others, making the person more likely to claim insurance. The “safer” your job is considered, the lower your premium will be.

The amount you drive.

Those who spend more time on the road are more likely to pay higher insurance premiums. You are more likely to be involved in an accident than those with lower mileage. Things like commuting to work on public transport instead of driving will help to bring your mileage down and, therefore, your premium.

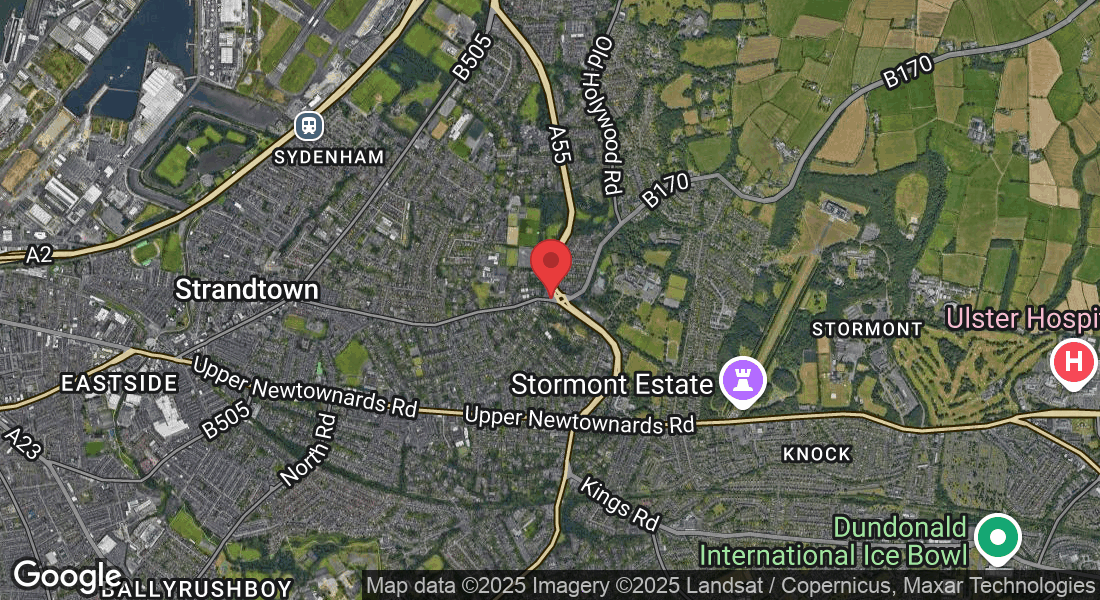

Location

Where you live and how you keep your car affects this insurance cost. Areas that have seen lower insurance claims mean your vehicle, too, will feel that benefit. Alternatively, if you live in an area that experiences high claims, you’ll likely pay more for insurance. Premiums will also be affected whether you have the security of a driver or garage to park your car overnight instead of street parking. This is considered more of a theft risk and will increase your insurance.

Criminal Convictions

If you have had past criminal convictions, your insurance is likely higher. Commonly, this is points on your licence for things such as speeding. This deems you a higher risk to the car insurance company, so you will be expected to pay more.

Additional Drivers

Adding someone as an additional driver can decrease your overall premium when sharing a car. It is worth noting that this will only positively affect your policy if the other named driver is deemed “experienced” and maintains a no-claims discount.

3. How do I make a car insurance claim?

The way you make a claim on your car insurance will vary depending on what’s happened and the process set out by your provider. Generally, you’ll need to:

o Compile evidence of the car accident or incident that occurred

o Familiarise yourself with your policy’s terms and conditions

o Inform your insurer of the events as soon as possible (ideally within a day)

o Fill in any relevant forms and gather documents so that your claim can be processed

o Pay any excess charges you’re presented with

You could save up to £523*’ for Car Insurance and ‘You could save up to £222*’ for Home Insurance.. The saving was calculated by comparing the cheapest price found with the average of the next five cheapest prices quoted by insurance providers on Seopa Ltd’s insurance comparison website. This is based on representative cost savings from August 2024 data. The savings you could achieve are dependent on your individual circumstances and how you selected your current insurance supplier.

Connect Through Service Limited is an Introducer Appointed Representative of Seopa Ltd (FCA reg. number 313860)

trading as Quotezone

Northern Ireland Blue Lights Awards

We are proud to announce the inaugural Northern Ireland Blue Light Awards, a powerful Awards Ceremony which serve as a tribute to the exemplary individuals within the emergency services who dedicate their lives to our safety. These unsung heroes are the backbone of our communities.

These prestigious Awards provide a platform to acknowledge their selflessness, commitment, courage and enduring professionalism, often displayed in the face of challenging circumstances.

The award categories will be free to enter, and they will be open to any individual or station within the Emergency Services in Northern Ireland.

Chosen Charities Charity 2024

Blesma

The Limbless Veterans, is dedicated to assisting serving and ex-Service men and women who have suffered life-changing limb loss or the use of a limb, an eye or loss of sight in the honourable service of our country.

Air Ambulance Northern Ireland

Work in partnership with the Northern Ireland Ambulance Service (NIAS), to provide the Helicopter Emergency Medical Service (HEMS) for the region.